Designer Brands Inc. (NYSE:DBI), the footwear retailer, has continued to report weak financials after my previous article on the stock – the company lowered its FY2023 guidance with the Q3 report as I previously wrote in the article, and the Q4 weakness seemingly related to inventory cleansing led to a -28% sell-off following the report that was quickly mitigated as the stock rose back. The start of FY2024 has started with less noticeable weakness so far, and Designer Brands expects improvements in the rest of the year.

In my previous article, published on the 19th of December with the title “Designer Brands: A Soft Market Or Company?” I suggested that the company’s weak financial performance was both a result of macroeconomic pressures and company-specific issues in attracting demand. As the valuation reflected Designer Brands’ weakness, I initiated the stock at Hold. Since, the stock has lost -12% of its value whereas S&P 500 has returned 16%.

My Rating History on DBI (Seeking Alpha)

Financial Performance Sees Gradual Improvement from Weak Q4

After the prior article, Designer Brands ended FY2023 with in incredibly weak Q4 report, in line with the guidance. Comparable sales declined by -7.3% leading to sales of $754.3 million, and the adjusted EPS fell to -$0.44 from a positive $0.07 in the prior year. Profitability took a large hit as sales continued to be weak, and as an inventory cleanse to improve the assortment pushed down the gross margin by 1.7 percentage points year-over-year. The inventory cleansing was mentioned in the Q4 earnings call to be a result of significant promotional campaigns during Black Friday and Cyber Monday, ending the inventories at a much healthier level and assortment after the quarter. The quarter’s weakness was already previously guided for, and while the stock nosedived into the results at first, the stock quickly rose back up.

Designer Brands’ Q1 results followed up showing a still weak, but improved performance. Comparable sales declined -2.5% leading to a 0.6% sales increase into $746.6 million. With an improved inventory position, the company managed to raise the gross margin by 0.8 percentage points year-over-year into 32.8%.

Yet, operative costs continued with quite high inflation pushing operating income down to $6.5 million from $23.4 million a year ago – to keep up healthy operating income, Designer Brands needs to be able to still generate better sales.

FY2024 Outlook Expects Continued Gradual Improvements

Designer Brands gave a financial outlook with the Q4 report expecting sales up low-single digit percentages and an adjusted EPS of $0.7-0.8, up slightly from $0.68 in FY2023. The outlook was reaffirmed with the Q1 results.

The outlook expects clear profitability improvements after Q1, aided by very gradual sales improvements during FY2024. Designer Brands communicated in the Q1 earnings call that assortment management and marketing initiatives have gradually started to show results, making the management confident in improvements in the rest of the fiscal year. Also, investments into an improved customer omnichannel experience have started to slowly show results according to CEO Doug Howe. Andrea O’Donnell, Designer Brands’ President, ended her segment of the call with confidence:

“In conclusion, my team and I have developed a strategy and a three-year plan. ’24 is about reducing waste, driving efficiency. ’25 is leveraging our strengths to grow both growth margin and sales. And ’26 is really about scaling and scaling fast.”

The FY2024 financial guidance still leaves space for margin and sales improvements after FY2024, as the guidance expects only slight improvements from the weak FY2023. I believe that investors should watch the company’s sales and gross margin performance very carefully in the upcoming quarters, as it seems that the strategic improvements should soon start to show results.

The Valuation Seems Balanced

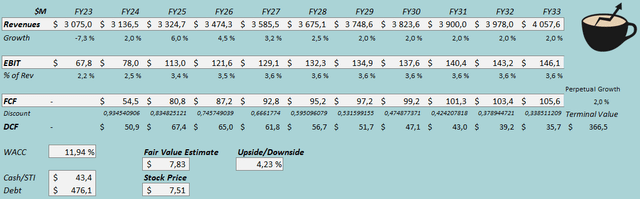

Despite the stock’s poor performance, I still don’t believe Designer Brands to be a very attractive investment in a base scenario. As profitability has dragged and comparable sales continue to fall, I believe that more conservative discounted cash flow [DCF] model estimates are in place.

From the previous model, I updated the sales estimates, now expecting a better comparable sales recovery in FY2025 and FY2026. Afterwards, I still estimate a decline back to 2% perpetual growth, ending revenues at a very similar level as previously.

As margins have continued to be pressured by lowering sales and SG&A inflation, I now only estimate an eventual EBIT margin of 3.6% instead of 3.8% previously. Better margin leverage than anticipated could make Designer Brands’ stock very attractive, but as a base scenario, I don’t believe that higher margins should be anticipated. The estimate still expects continued margin expansion after FY2024.

DCF Model (Author’s Calculation)

The estimates put Designer Brands’ fair value estimate at $7.83, near the stock price at the time of writing – after the weak performance and stock fall, the stock now seems to be roughly fairly valued with my base scenario expectations. Future margins mainly determine the fair value, though, and the current estimates could still widely fluctuate with Designer Brands’ future ability to attract sales. The fair value estimate is down slightly from $8.26 previously.

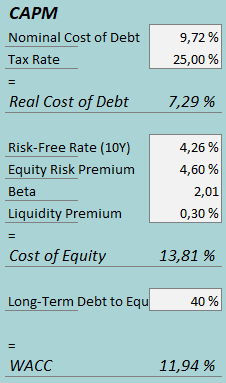

A weighted average cost of capital of 11.94% is used in the DCF model, down from 13.49% previously due to a lower current equity risk premium. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Designer Brands had $11.6 million in interest expenses, making the company’s interest rate 9.72% with the current amount of interest-bearing debt. I continue estimating a long-term debt-to-equity ratio of 40%, below the current one with Designer Brands’ low equity valuation.

To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.26% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. I have kept the beta estimate and liquidity premium the same at 2.01 and 0.3%, respectively, creating a cost of equity of 13.81% and a WACC of 11.94%.

Takeaway

Designer Brands’ weakness has continued with an incredibly weak Q4, but a slightly improved Q1 as inventory management has led to more healthy margins and sales. The company expects the slight momentum to continue into FY2024 and beyond as assortment, marketing, and omnichannel experience improvements have started to gradually slow results. I believe that investors should watch the performance cautiously as the operating margin continued to decline in Q1 – the sustainable margin level outlook, driven largely by sales improvements, mainly determines the investment case. I see the current valuation as balanced, and maintain Designer Brands at a Hold rating.

Read the full article here