With e-Commerce sales booming and the share of e-Commerce retail sales growing, REITs focused on this specific sector have attractive long term growth potential. One REIT that is worth paying attention to is STAG Industrial (NYSE:STAG) as it is heavily benefiting from the e-Commerce revolution. Besides the e-Commerce focused real estate footprint, STAG is expanding its portfolio through acquisitions, which is reflected in growing FFO and dividend payments. I believe that the risk profile for STAG is skewed to the upside in the long term as the REIT is filling an important and growing niche in the market!

STAG’s competitive position, rent and FFO growth

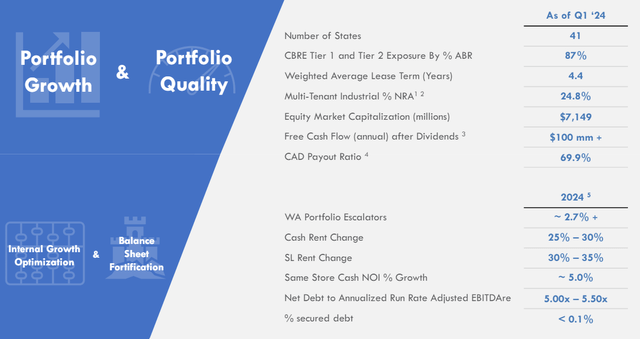

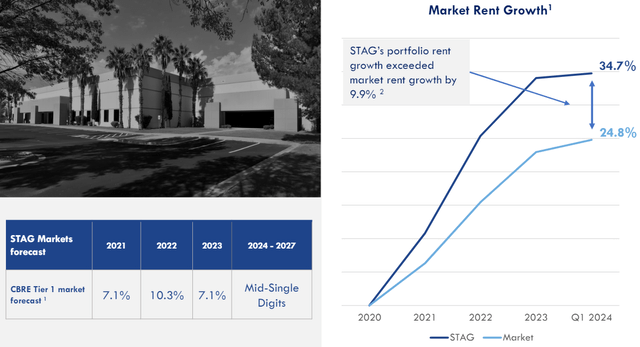

STAG is a REIT that chiefly invests in single-tenant properties in the U.S. industrial market. The REIT’s portfolio was comprised of 570 buildings as of the end of the March quarter which had an operating occupancy of 97.9%. The weighted-average lease term was 4.4 years and the majority of the portfolio (75%) is represented in CBRE Tier 1 markets. Tier 1 markets are highly established and growing markets, making real estate development and leasing especially attractive. STAG’s focus on Tier 1 cities is one reason why the REIT has been able to grow its rent at above-market rates in the past.

STAG

Industrial facilities are in high demand which is why STAG has seen strong demand for them in the last few years and the outlook is favorable as well. High demand for industrial facilities has led to market-beating rent growth for STAG and the REIT is benefiting from associated funds from operations growth.

STAG

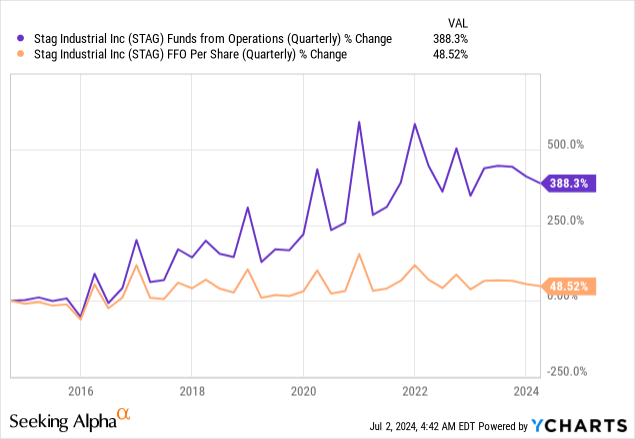

STAG’s FFO has surged in the last decade, mainly because the REIT is doing a lot of acquisitions. In the last ten years, STAG’s funds from operations have risen 388%, or almost 50% on a per-share level. This growth is directly link to the growing demand for industrial real estate as well as the strong lease position landlords have found themselves in.

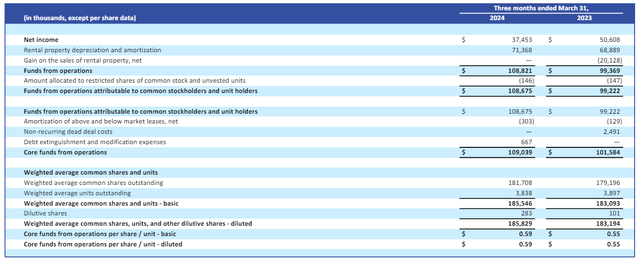

The FFO momentum referenced above continued for STAG in the first-quarter. In Q1’24, STAG generated $109M in core funds from operations, showing 7.3% year over year growth. My expectation for STAG is to keep growing its portfolio through select acquisitions in the industrial market and grow FFO chiefly through the lever of portfolio transactions.

STAG

Favorable long term e-Commerce outlook

E-Commerce sales are in an up-trend due to the wide proliferation of smartphones and companies investing into online store fronts to appeal to consumers. With more people coming online each year, companies that have exposure to this growth industry are facing attractive long term growth prospects as well.

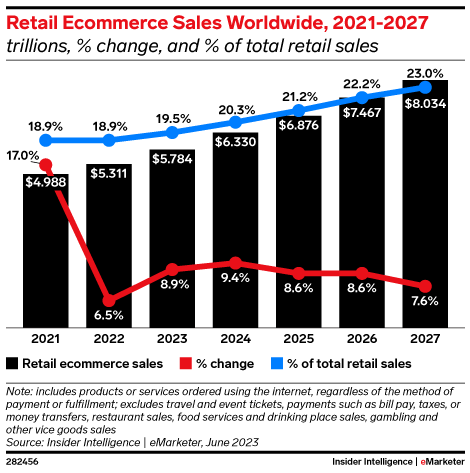

Retail e-Commerce sales are on a long term upward trajectory, with the pandemic boosting industry sales significantly. While growth rates have moderated since 2022, due to the end of the pandemic, the e-Commerce market is set to continue to expand. Between FY 2023 and FY 2027, global e-Commerce sales are expected to grow to $8.0T, showing an average annual growth rate of 9%.

STAG

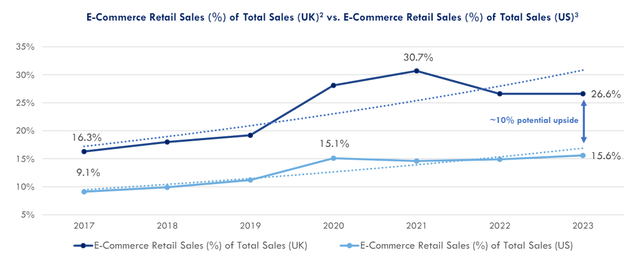

E-commerce retail sales are a fundamental growth driver of STAG’s customer base. These customers lease warehouse and distribution space from STAG and are therefore fundamentally linked to the prospects of the e-Commerce industry. The share of e-Commerce retail sales is also growing both in the U.S. and the UK (see chart below) which indicates that demand for e-Commerce-related facilities, such as distribution centers, is going to increase going forward. Based off of the last tenant breakdown in STAG’s supplemental report, Amazon is STAG’s largest tenant, responsible for about 2.9% of the REIT’s annual base rent.

STAG

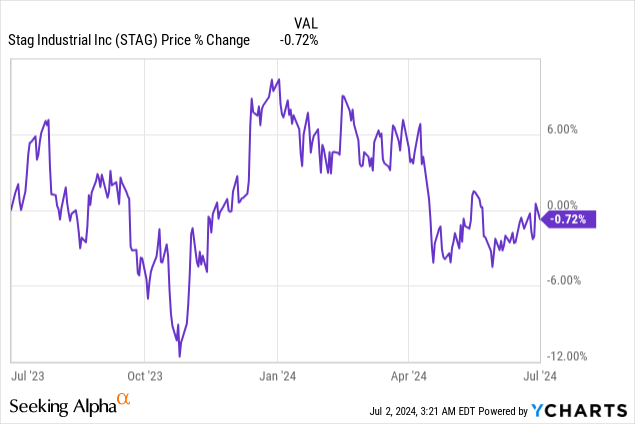

STAG’s valuation

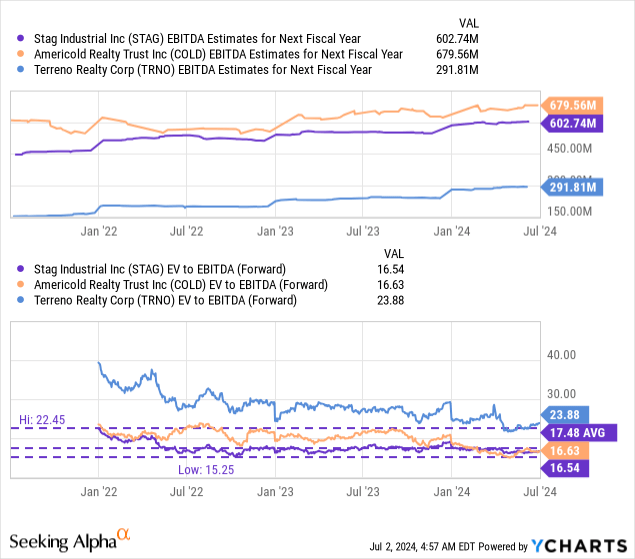

STAG is valued at an enterprise-value-to EBITDA ratio of 16.5X, the lowest ratio in the industry group consisting of Americold Realty (COLD) and Terreno Realty (TRNO). I am using an enterprise-value-to EBITDA ratio because REITs are large-scale real estate investors and depreciation expenses can skew earnings results. STAG is currently trading 5% below the 3-year enterprise-value-to EBITDA average ratio of 17.5X and 13% below the industry group enterprise-value-to EBITDA ratio of 19.0X, based off of FY 2025 EBITDA.

STAG, however, can be expected to grow its FFO, mainly through acquisitions in FY 2024 and beyond, and the large concentration of STAG’s real estate assets in Tier 1 markets indicates to me that the REIT has attractive long term prospects to raise its rents at above market rates. Therefore, I believe it would be entirely reasonable for shares of STAG to revalue to the industry group average valuation ratio of 19.0X in the longer term which implies a fair value of $41.

Risks with STAG

The e-Commerce industry is volatile and dependent on consumer spending. Therefore, the biggest risk for STAG, as I see it, relates to a potential down-turn in the economy and slowing growth in the core e-Commerce segment especially. Since STAG is a pure-play industrial REIT, a consumer spending-driven down-turn in the economy would hurt the REIT more than other REITs that have more diversified real estate footprints.

Closing thoughts

STAG is a promising pure-play REIT in the industrial market niche whose fortunes are connected to the broader e-Commerce industry. As a result, STAG has attractive prospects for long term rent, FFO and dividend growth… which makes the REIT especially suitable for those investors that are focused on generating monthly income from their investments. STAG is capable of growing its rents at above market rates, chiefly because of the company’s focus on CBRE Tier 1 markets where demand for industrial space is high… and where landlords have strong bargaining positions. In my opinion, shares of STAG have revaluation potential in the long term and the 4.2% dividend yield, paid monthly, is attractive as well!

Read the full article here