Ellington Credit Co. (NYSE:EARN), formerly known as Ellington Residential, rebranded to its present name in April 2024, as part of a broader business pivot away from Mortgage-Backed Securities and toward Collateralized Debt Obligation market which is where the company has some experience with.

The trust is also transitioning from a real estate investment trust to a closed end fund and regulated investment company/RIC, but management clarified that it is the company’s ambition to keep paying shareholders a $0.08 per share per month dividend.

With a 5% discount to book value to boot and the dividend being well-covered by adjusted distributable earnings, I think that the 14% covered yield remains a ‘Buy’ for passive income investors.

My Rating History

My last stock classification for Ellington Credit was Buy and I am maintaining EARN as a ‘Buy’ as the company pivots away from mortgage-backed security investments, which are heavily rate-dependent, to Collateralized Debt Obligations which have less interest rate risk.

Since the trust reaffirmed that it is looking to pay $0.08 per share per month to investors moving forward, I don’t see the dividend being at risk.

Strategic Transformation, Evolving CLO Focus

Ellington Credit is transitioning its business model and will be much more focused on Collateralized Debt Obligations moving forward. Collateralized Debt Obligations, or CLOs for short, are securitized investment products that are backed by diversified pools of, typically leveraged, loans. Because these loans tend to be also floating-rate, investments in CLOs have less interest rate risk. This in turn could lead to less-volatile earnings, and thus a higher degree of earnings quality.

This pool is sliced into different tranches that have varying degrees of risk and allow credit investors to pick an investment that suits their unique income needs and risk tolerance.

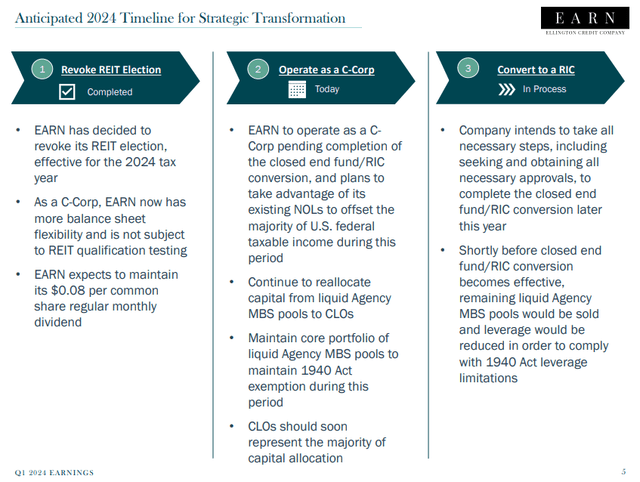

To accomplish this business transformation, Ellington Credit has revoked its REIT classification and now operates as a C-Corp until the conversion process to a registered investment company is completed. This is anticipated to happen later this year.

Anticipated 2024 Timeline For Strategic Transformation (Ellington Credit Co)

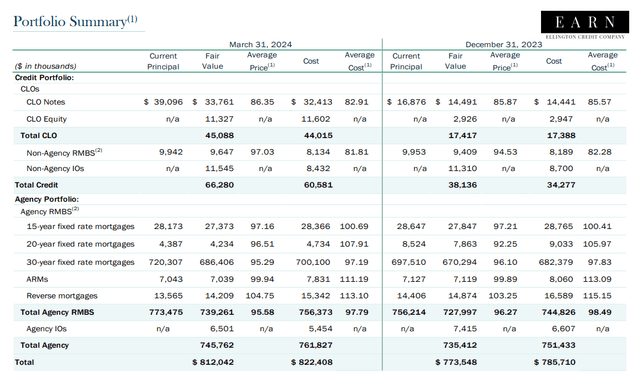

Ellington Credit has experience in CLO investing and owned $45 million of such investments as of March 31, 2024. The trust’s bread-and-butter, however, are still Agency Residential Mortgage-Backed Securities which had a combined value of $739.3 million. The company’s plan is to liquidate the Agency MBS portfolio and reinvest the proceeds into Collateralized Debt Obligations.

Portfolio Summary (Ellington Credit Co)

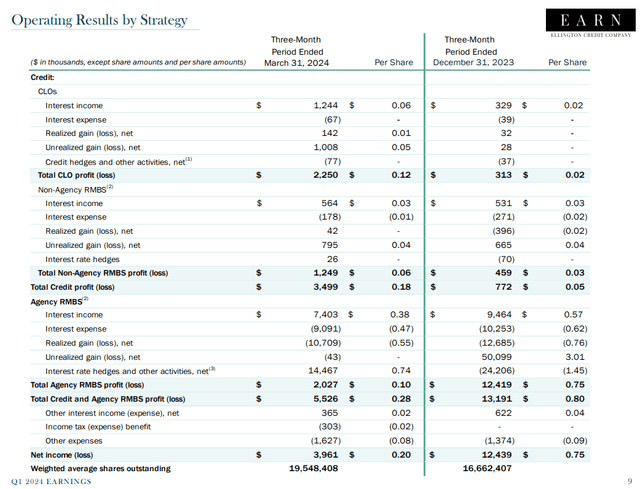

Logically, Mortgage-Backed Securities accounted for the majority of earnings in 1Q24: MBS profits totaled $3.3 million, or 59% of all profits, before interest expenses, taxes and other expenses. CLOs, on the other hand, contributed $2.2 million, or 41% of total segment profits. In the future, this allocation is going to change and the portfolio will consist primarily of interest-paying CLO investments.

Furthermore, Ellington Credit should see much less earnings volatility reflected in its operating results as the negative impact of interest rate changes on the company’s MBS investments is removed.

Operating Results By Strategy (Ellington Credit Co)

Steady Pay-Out Ratio, Positive Dividend Outlook Despite Business Pivot

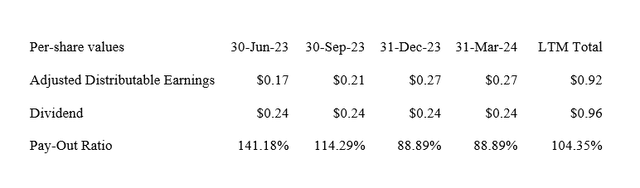

Ellington Credit earned $0.27 per share in adjusted distributable earnings in the first quarter while the dividend pay-out of Ellington Credit amounted to $0.24 per share.

The dividend pay-out ratio was unchanged at 89% and management clarified that it seeks to continue its current dividend pay-out policy of paying $0.08 per share per month and this is independent of the change in legal status and the business pivot toward corporate collaterized debt obligations.

Ellington Credit’s dividend pay-out ratio in the last year was 104%, but the company’s pay-out metrics improved considerably in the last two quarters.

Dividend (Author Created Table Using Trust Information)

4% Discount To Book Value

Ellington Credit is selling for a discount to book as a lot of mortgage investment companies do. Ellington Credit had a book value per share of $7.21 as of March 31, 2024, reflecting an $0.11 per share change compared to the previous quarter.

With a stock price of $6.87, Ellington Credit is presently selling at a 4% discount to book value. Book value tends to be a sensible approximation of intrinsic value for Ellington Credit as mortgage trusts are required to apply fair value accounting rules to the assets they hold on their books.

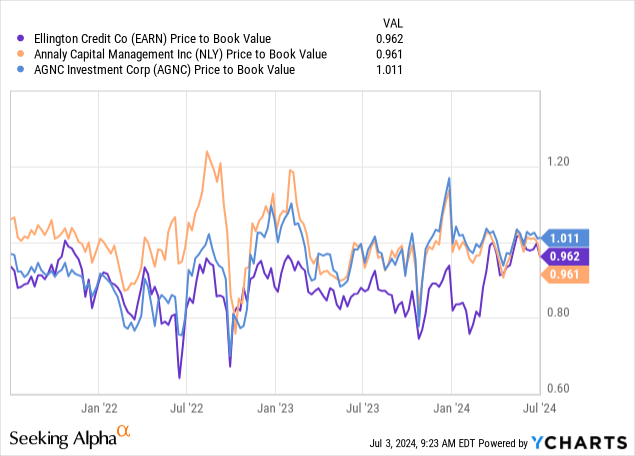

Annaly Capital Management, Inc. (NLY) and AGNC Investment Corp. (AGNC) are presently selling at book value multiples of 0.96x and 1x.

Though I don’t see a particular valuation advantage for EARN compared to the two other mortgage trusts, there is a chance that passive income investors value the transformed Ellington Credit at a higher book value multiple if the divestment of Mortgage-Backed Securities results in a higher quality of earnings (less earnings volatility).

Why The Investment Thesis Might Not Pan Out As Anticipated

The central bank is keeping short-term interest rates higher-for-longer which has hurt the mortgage trust sector a little bit, primarily because mortgage REITs tend to carry quite a bit of leverage in order to earn a profit on their mortgage securities.

Since Ellington Credit is planning on liquidating its Mortgage-Backed Securities portfolio as part of its change in business model, this is going to be less of a headwind for EARN.

Other headwinds could be a potential failure to complete the RIC conversion (anticipated for the end of the year) or Ellington Credit’s failure to transition to CLO investments.

My Conclusion

Ellington Credit is an attractive investment option for passive income investors as the company is in the process of becoming a closed end fund/RIC and enact a major change in its business model.

The main reason why I am bullish on Ellington Credit is that the company out-earned its dividend with adjusted distributable earnings in the last two quarters which has restored healthier pay-out metrics.

Since management has said that it is looking to maintain the $0.08 per share per month dividend even as the business pivots to CLOs, I am not worried about the dividend.

Since the yield is presently anchored at 14%, I think that Ellington Credit remains a compelling investment, particularly for passive income investors. Buy.

Read the full article here