Summary

Following my coverage on The Middleby Corporation (NASDAQ:MIDD) in Jun’24, in which I recommended a sell rating due to my expectation that MIDD is likely to miss consensus FY24 EBITDA estimates, this post is to provide an update on my thoughts on the business and stock. I am now giving MIDD a hold rating (upgrade from sell) because the 2Q24 results and recent macro developments have reshaped my outlook for the business. I now see potential for MIDD’s Commercial Foodservice [CF] segment to see strong organic growth acceleration, which may drive a strong multiple re-rating upwards. However, it is still too early to determine if this is the case. As such, I am staying on the sidelines for now.

Investment thesis

On 01-08-2024, MIDD released its 2Q24 earnings, which saw total sales of $992 million, supported by ~$619 million in CF, ~$193 million in Residential Kitchen [RK], and ~$180 million in Food Processing [FP]. The segments saw -4%, -6.2%, and -5% declines on a reported basis and -3.9%, -6.7%, and -5.7% organically, respectively. Declining revenue performance drove the adj EBITDA margin down 22% to 21.8%, but the CF EBITDA margin held up well, expanding by 30bps y/y. As a result, total company adj EBITDA saw $216 million, and this led to adj EPS declining from $2.48 to $2.39, a ~4% decline.

The incremental data shared in the 2Q24 report and the macro changes have caused me to change my views on MIDD’s FY24 outlook. Recall in my previous post, my biggest concern was that the CF segment (the largest segment for MIDD) is unlikely to see order growth improvement due to two reasons: (1) inflation remained sticky and (2) interest rates remained high. Both of these concerns seem to be going away as the latest CPI data shows inflation coming down nicely (now below 3%), which I now expect to go further down considering consumers are pulling back on spending and retailers are cutting prices. This bodes well for the fed to really cut rates this time around, which does seem like they will, given the message sent.

In addition, the underlying demand environment appears to have recovered much faster than I expected, as MIDD saw 9% sequential order growth in 2Q24 and that order trends have normalized (per management). Importantly, the inventory oversupply situation is in the rear mirrors, wherein orders are now more closely aligned with demand. If I am right about the direction that the macro economy is heading in (an upcycle), demand will start to recover, especially with lower interest rates that lower the cost of financing new restaurant openings.

The other issue that I had concerns about was the price increase (took effect in June). Surprisingly, this did not impact demand (orders still grew 9% sequentially), and I think this reflects positively on the demand situation. Also, management noted that the competitive promotional landscape is done and dusted, now back to a normalized situation vs. pre-COVID levels. This indicates to me that the oversupply situation has gotten better (no need to aggressively implement promotions to clear inventory) and demand has improved (no need for competitive promotions to capture demand).

That said, these developments do not mean that MIDD is in a growth cycle already. I would say MIDD is still in the transition phase, where more convincing data needs to be seen before investors can be confident about the growth outlook. In particular, order growth has yet to be translated into revenue growth (orders grew 9% sequentially, but CF revenue only grew 5% sequentially). Customers are still pushing out their new store opening timeline, which I think is going to stay this way until they gain confidence in the Fed’s decision on rates. A leading indicator I am tracking to know whether the restaurant industry is back in growth mode is the Restaurant Performance Index by the National Restaurant Association. Until this data turns above 100 (indicating the industry is in expansion mode), I will remain in observation mode for MIDD’s CF segment.

NRA

The RK segment is another segment that I think deserves monitoring (I previously only focused on the CF segment because it was the largest) given the macro changes. While RK saw an organic sales decline of 670 bps in 2Q24, which drove the adj. EBITDA margin down by 470 bps y/y, I think 2H24 is going to do much better than 1H24. The main driver for this segment is housing demand, which is impacted by multiple factors like housing starts, existing home inventories, and mortgage rates. Positively, unlike in 1H24, the development and outlook of all these have improved.

- Housing starts have continued to improve since the trough saw in May.

- Existing home inventories have improved since the start of the year.

- Mortgage rates have come down, which should continue to go down as the fed cuts rate, and this should cause the above two points to further improve (lower rates drive housing demand, which drives housing starts; lower rates cause more existing homeowners to list their homes, which improves the housing supply situation).

There seem to be early signs of these reflecting in MIDD books, as the segment saw its strongest order quarter over the past 24 months (orders were up 14% sequentially). Suppose this segment improves as I expect, it would certainly help MIDD in meeting FY24 EBITDA estimates.

Valuation

Own calculation

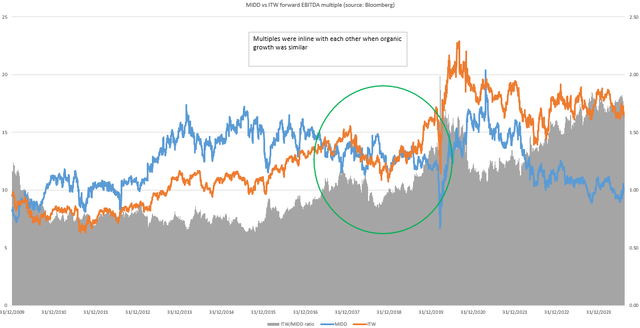

My view of MIDD has gotten better since June because of the order performance and macro developments, and this has impacted the way I view MIDD’s valuation today. A key reason why I think MIDD has continued to trade below Illinois Tool Works (ITW) is because of the lower organic growth so far. However, if MIDD’s CF segment starts to print positive organic growth improvement, supported by orders translating into actual revenue and a better demand environment, this valuation gap could close.

Historically, pre-covid, MIDD trades at a premium to ITW at around 1.1x. The situation flipped when MIDD started to report lower organic growth (refer to my previous post for comparison). Suppose both companies start to report similar organic growth strength (this happened in 2018). Both companies should trade in line with each other. Hence, if MIDD’s CF segment organic growth reaccelerates to ITW’s level (ITW reported 2.5% organic growth for its food equipment segment in 2Q24), MIDD may see a strong rerating to ITW’s multiple of 17x forward EBITDA, which will represent a massive upside.

Overall, my current view is that MIDD’s upside scenario hinges on its CF growth accelerating to ITW’s level. I acknowledge the potential, and the current macro setup is leaning toward favorable for MIDD. However, I think it is too early to conclude that this will happen in the near term; hence, I am giving it a hold rating.

Conclusion

In conclusion, my rating for MIDD is now a hold rating as recent performance and the evolving macroeconomic landscape have reshaped my investment thesis. I am not upgrading to a buy because the current data is still insufficient to convince me that MIDD is going to see strong growth acceleration for its CF segment, which I believe is a key element to multiples re-rating upwards. For now, I think the best course of action is to continue monitoring key metrics, such as order growth and the broader restaurant industry performance.

Read the full article here