Co-authored by Treading Softly

A common mistake that people make is assuming that this is the first time something has ever occurred. We often hear people say that “this has never happened before” or that there are no historical analogs for what is occurring. Unfortunately, a massive part of the human condition is the ability to rapidly forget the past. There’s a famous saying, “those who do not learn from the past are doomed to repeat it.”

If you look through many different aspects of human existence, we see that it is highly cyclical. For example, fashion comes in waves; things that were popular in the 80s became popular again in the 2010s, partially because of this recycling of past ideas. If you look at entertainment, we see that there’s just a massive recycling of previously great ideas resurfacing via remakes of movies that came out a long time ago. Can anyone remember the original Red Dawn and then the remake of Red Dawn? It’s the same story but different actors.

Humanity lives in cycles, and part of these cycles is the falling and rising of interest rates and the economic activity associated with them.

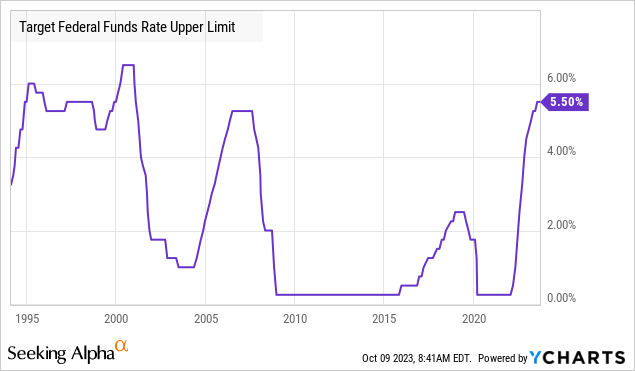

The Fed has hiked rates at an unprecedented pace, and we are starting to see cracks in the economy. Historically, when the Fed hikes rates quickly, something breaks. I hear many folks saying that interest rates might be “cut a little bit” next year. They believe that interest rates are going to just drift down a little bit but generally remain high.

That idea flies in the face of historical experience. Historically, interest rates have been slashed much more quickly than they rise. The Fed hikes, something breaks, and then they panic cut.

The one obvious exception is the “soft landing” that was engineered in the 1990s. I don’t think that is likely to happen again, as in 1995, the Federal Reserve cut interest rates just two months after inflation peaked and continued small cuts even as Core CPI remained above 3%. Today’s Fed is not even attempting to be proactive. I believe we are much more likely to see a hard landing – a recession with rapid rate cuts.

If that happens, there is one sector that I definitely want exposure to – Agency MBS (Agency Mortgage-Backed Securities). It is a unique asset class that consists of mortgages that are guaranteed by government-sponsored enterprises, aka the agencies. These agencies were created for the purpose of expanding homeownership in the U.S. If investors are lending money, they want to be paid back. So they are constantly considering the risk that a particular borrower might be unable to repay, and they will only be willing to invest a certain amount in risk assets. During a 30-year mortgage, there is a lot that can go wrong for the borrower – they could lose their job, have health issues, or, for other reasons, become unable or unwilling to pay their mortgage. As a result, the mortgage markets were constrained by the supply of willing investors to provide capital for lending.

How do you get investors to pony up more cash? You remove the risk. The agencies provide investors assurance that whatever happens to the loan, the investor will get their principal back. Suddenly, there are trillions available for mortgage lending. For all practical purposes, it is an “infinite” amount. Mortgage originators can originate as many qualified mortgages as they are capable of processing with the confidence that they will be able to sell it to Fannie Mae or Freddie Mac. The agencies then put their guarantee on it and have no problem finding willing investors to buy them. Banks, insurance companies, foreign governments, and even the Federal Reserve buy up agency MBS. The agency MBS market is extremely liquid and is very well capitalized. Since Agency MBS are viewed as having similar credit risk to U.S. Treasuries, the yields tend to be strongly correlated.

A Key MBS Pick

AGNC Investment Corp. (NASDAQ:AGNC), yielding 16%, is a mortgage REIT that takes advantage of the unique properties of agency MBS and their correlation to U.S. Treasuries. AGNC buys agency MBS utilizing a significant amount of leverage through “repurchase agreements”, aka repos. Repos are secured short-term financing that you can find for U.S. Treasuries or Agency MBS. AGNC profits from the difference between what they can borrow at and the coupon they receive from the MBS it owns.

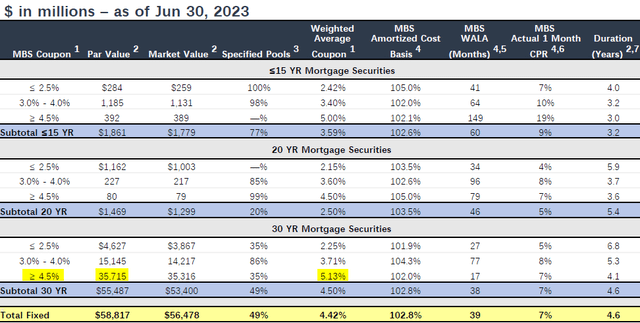

AGNC has been rotating up in coupon and currently has $35.7 billion in Agency MBS with a coupon of over 4.5%. Source

AGNC Q2 2023 Supplement

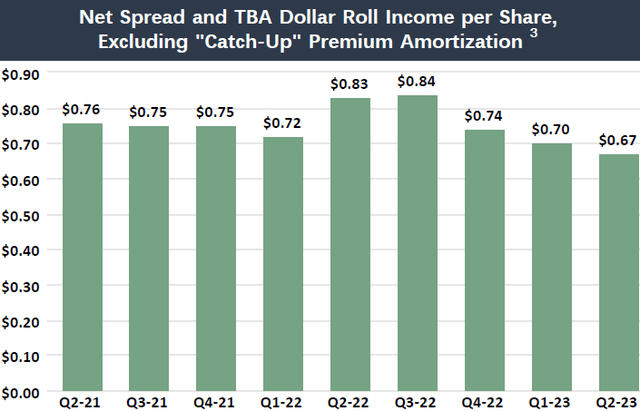

AGNC has faced headwinds over the past two years as the price of Agency MBS has decreased due to rising rates, cutting into book value. At the same time, cash flow has slowly compressed as the cost of borrowing has risen. AGNC has controlled the rise of interest expense through interest rate swaps. This has impacted the bottom line as earnings have slowly drifted lower (though still very easily covering the dividend).

AGNC Q2 2023 Supplement

Why do I say I want exposure to this if there is a recession and the Fed slashes rates to zero? Two things happen that benefit AGNC directly and immediately:

- During a recession, the prices of risk-free assets rise. Agency MBS prices rise right alongside the prices of U.S. Treasuries as investors run to safety. This will be beneficial for AGNC’s book value.

- The cost of borrowing crashes. AGNC borrows short-term, with repo agreements typically lasting 30-90 days. The interest rate on repos is very sensitive to the Federal Funds rate. When the Federal Funds rate is cut, AGNC’s cost of borrowing will decline quickly. With repo rates at 5%, receiving a 5-6% coupon might not look great. If repo rates decline to 2-3% or even lower, that 5-6% coupon is a money printing machine.

I don’t know exactly when the next recession will start, but I believe it could start soon, and when it starts, I want to have a full position in AGNC.

Conclusion

I may not know when the next recession is going to occur, but I can tell you that one is going to. With interest rates at all-time highs and compared to the historical patterns that we’ve seen – recognizing that humanity lives in these endless cycles of trying to be different in the past while stumbling into the exact same history – I want something that is going to benefit strongly when interest rates start getting slashed and the economy stumbles under the pressure of high-interest rates.

Today, AGNC yields over 16%, paying out strong monthly dividends directly into your account. Your coffers can be ringing month after month as money arrives while you wait for the worst to happen. It’s a cheap hedge against a very expensive reality that when the economy falters, so many other companies are going to be brought to their knees. A mistake investors often make is just simply looking at the chart. They don’t understand why the chart is down or up. They just simply look at a chart. If it’s gone down, they avoid it. If it’s gone up, they pile in. This is often why investors buy high and sell low due to the failure to understand the fundamentals of what is occurring.

I don’t want that for you as a professional income investor. I want you to understand what you’re buying, buy it with confidence, and be able to hold it even when others don’t understand what you’re doing. The writer on Seeking Alpha who bashes you for your holding isn’t you and doesn’t understand why you hold it. They may claim that they understand it all while mocking you, just like people used to mock the idea that the Earth was round because it looked flat from their perspective.

When it comes to your retirement, only you are responsible for the outcome; you’re responsible for your portfolio, and you’re responsible for the lifestyle that it provides you. If your portfolio is generating massive levels of income and you’re receiving a rising income stream – it doesn’t matter what the scoffer from the sideline says – and it’s meeting your needs, then you are successful as an income investor. I don’t need the scoffers’ cries to be what makes me feel successful and confident. I simply need the income to overwhelm my expenses.

There’s a special feeling when your portfolio provides every single one of your financial needs. If you are experiencing that, I am so happy for you! If you’re not experiencing that, I strongly recommend that you consider adapting your portfolio, even just in part, to follow our unique Income Method because, with it, you can find new levels of financial security and independence that you’ve never had before.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here