Introduction

Skyline Champion Corporation (NYSE:SKY) is a leading manufacturer of prefabricated homes in the United States and Canada. As the overall housing market, Skyline is experiencing an adverse economic environment. Still, it has the capacity to maintain its operations. It is well-positioned to capitalize on the future growth in the industry thanks to its large manufacturing capacities, retail footprint, and economies of scale. Nevertheless, I think its shares are slightly overvalued.

Business Overview

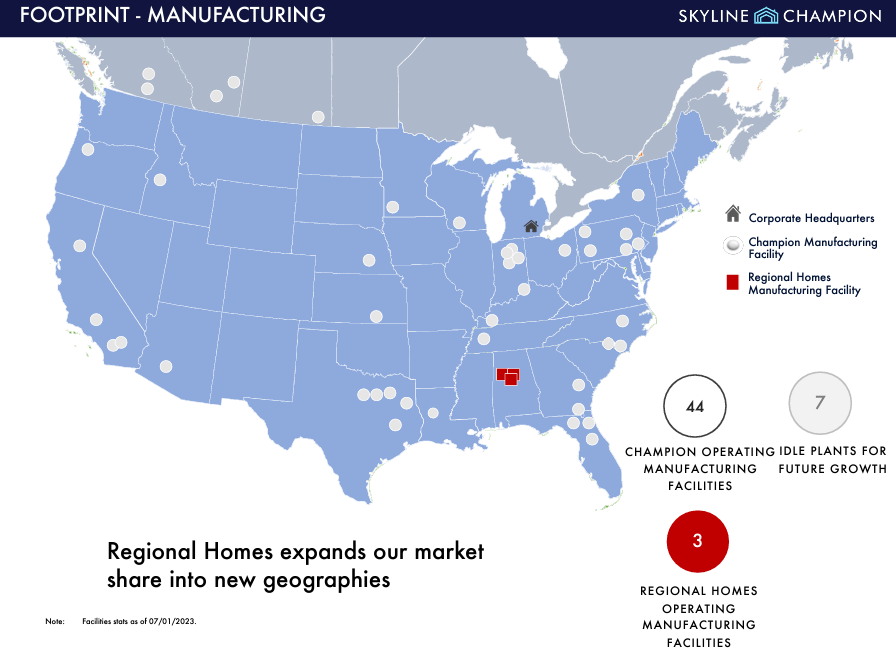

Skyline Champion Corporation is a leading producer of factory-built housing in North America. The company has over 70 years of homebuilding experience and operates 44 manufacturing facilities in 19 United States and three provinces in western Canada. Skyline Champion offers a wide range of factory-built homes, park model RVs, accessory dwelling units, and modular buildings for the multi-family and hospitality sectors. The company’s manufacturing facilities are strategically located to serve vital regions in North America.

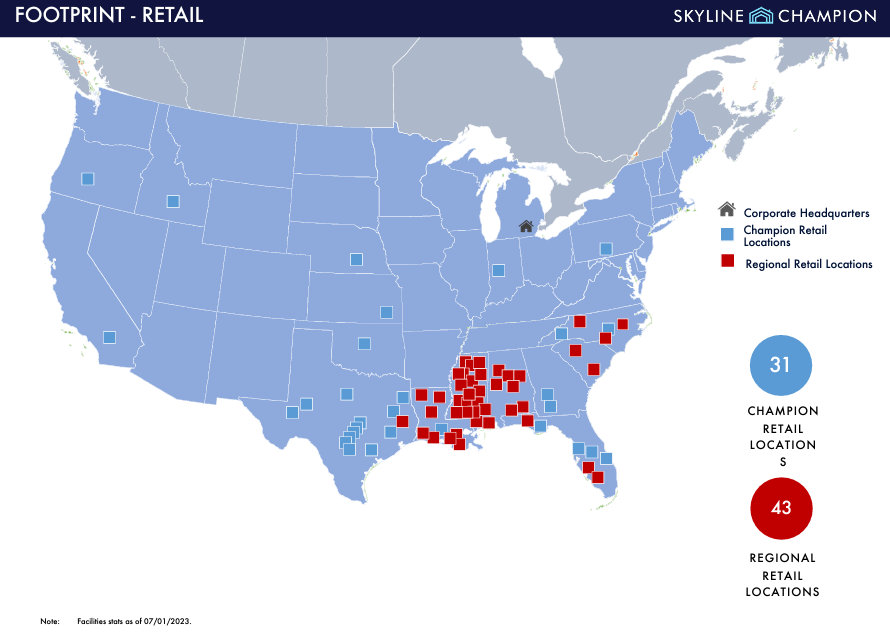

Skyline Champion is the number two manufactured housing producer in the United States, the number one modular builder in the United States, and a leading player in the western Canadian market. The company’s leading positions are driven by its comprehensive product offering, strong brand reputation, broad manufacturing footprint, and complementary retail, construction services, and logistics businesses. In addition to its core home-building business, Skyline Champion also provides construction services to install and set up factory-built homes, operates a factory-direct manufactured home retail business, and provides transportation services to manufactured housing and other industries.

Skyline Champion Corporation is a significant player in the factory-built housing industry and is well-positioned to benefit from the growing demand for affordable housing in North America.

Competitive Landscape

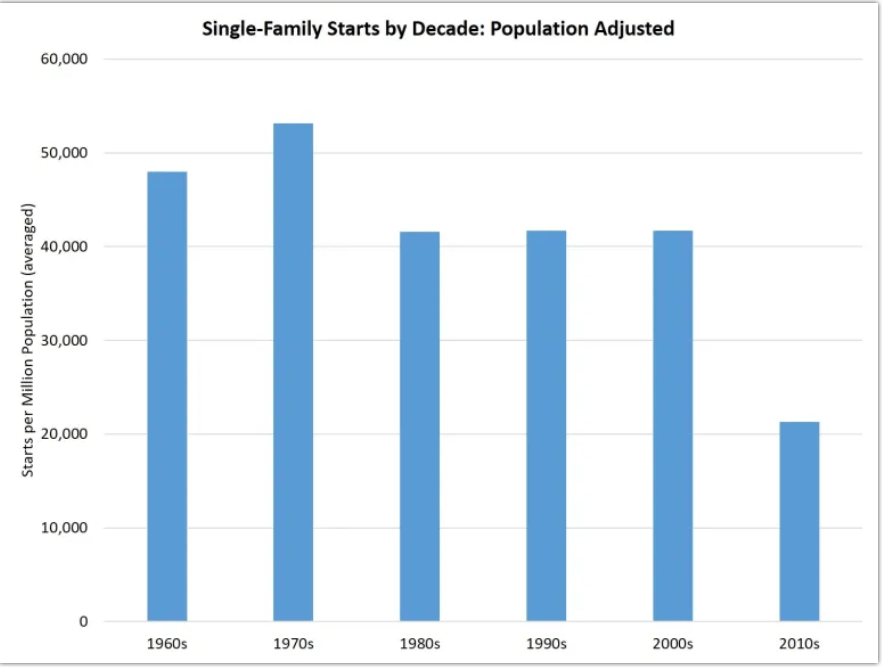

The first competitors are pre-existing homes, as perfect substitutes for manufactured and modular homes. Pre-existing homes are a potential threat, as a country won’t need any new houses if there are plenty of vacant houses in the market. Nevertheless, it’s not the case for the US, which experienced a significant underproduction of new houses after the Great Recession. Thus, currently, there is a gap between total household formations and home constructions of 2.3 million homes. The shortage is the consequence of low construction activity relative to population increase.

National Association of Home Builders

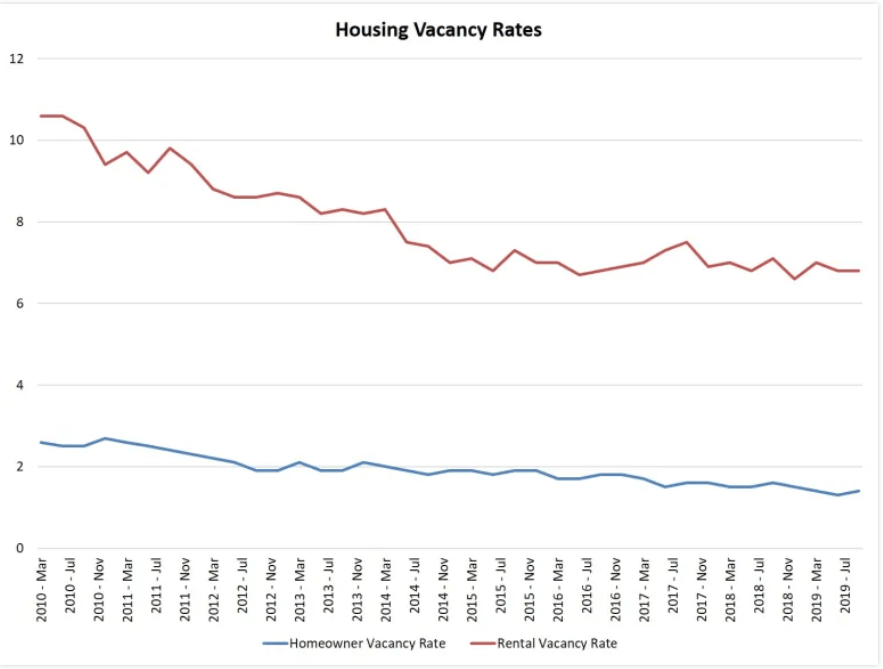

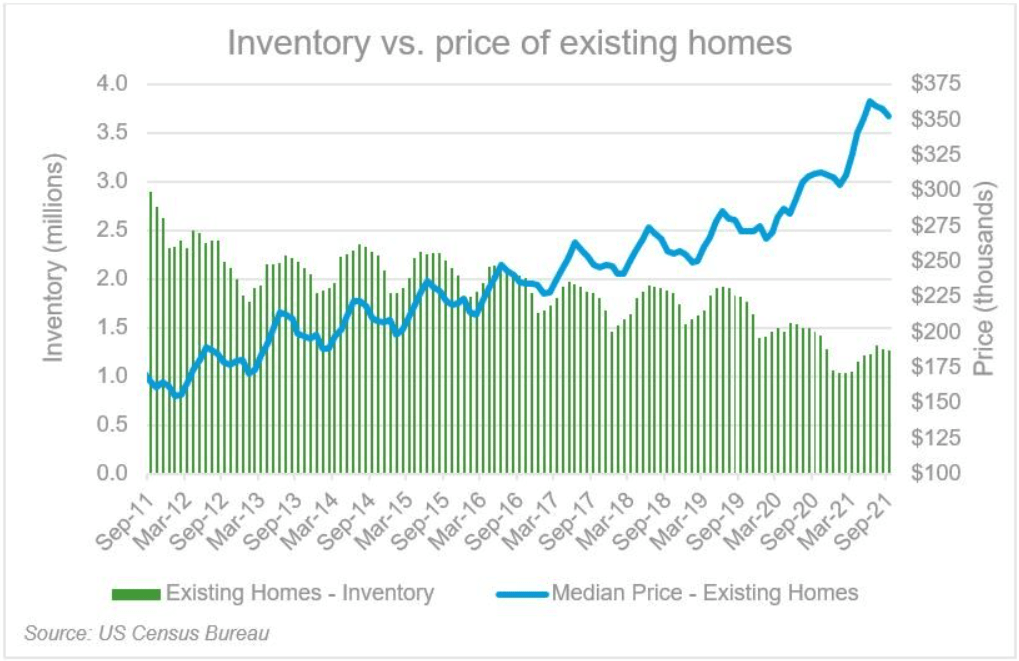

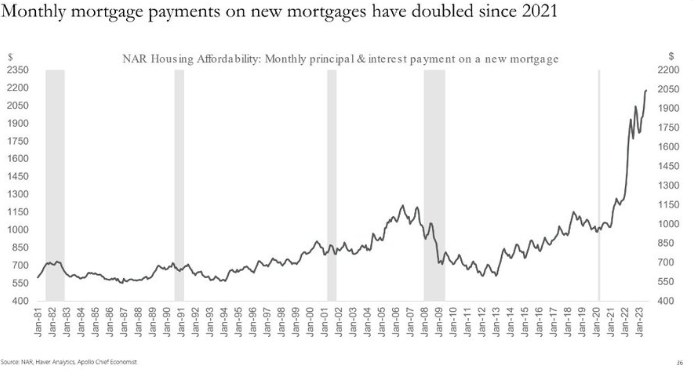

Consequently, the house vacancy rate and affordability have fallen since 2010. The affordability fell even further when mortgage rates skyrocketed due to the fight against inflation through interest rate hikes.

National Association of Home Builders US Census Bureau

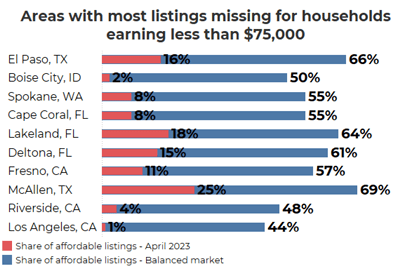

According to the National Association of Realtors (NAR), only 23% of the 1.1 million homes listed were affordable to households with incomes lower than $75,000 (51% of the total population), indicating that the home shortage is worse among low-income households.

National Association of Realtors

The problem is especially acute in Florida, Texas, and California, where the share of affordable houses is meager. However, I think this represents a unique opportunity for Skyline as it operates many manufacturing plants and retail locations in those states, so it could address the affordability problem with cheaper homes as its locations are close enough to be cost-effective.

National Association of Realtors

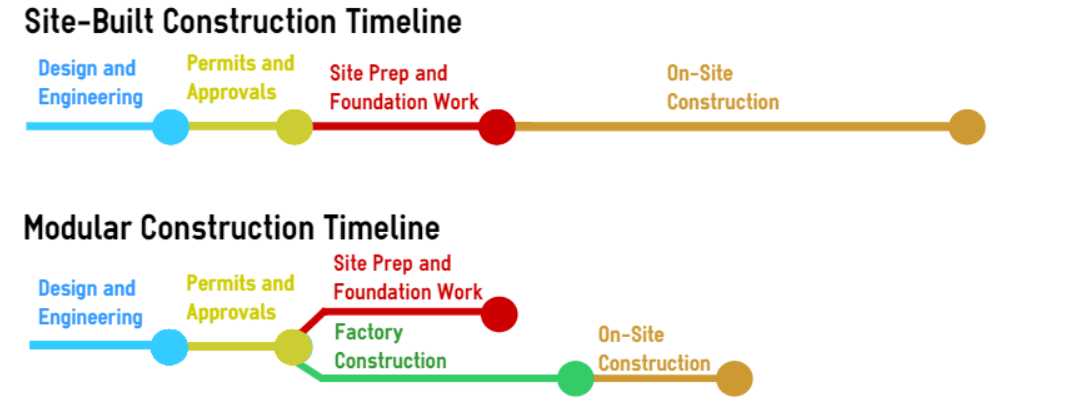

Homebuilders, such as D.R. Horton (DHI) or NVR, Inc. (NVR), can also address the shortage of homes; nevertheless, they tend to be more expensive than manufactured and modular homes. Some reasons for the higher costs are:

-

The work in-site is less efficient than the work in plants.

-

The work inside plants is not affected by adverse weather conditions.

-

Site-built homes require longer timelines to finish the construction than pre-fab homes.

Modular Homeowners

Nonetheless, in-site-built homes offer more customization than modular and specially manufactured homes. Furthermore, they are more durable than manufactured homes and have better financial markets to support their mortgages. Manufactured homes have a negative reputation for being less durable than in-site-built homes, which limits the ability of buyers to take a mortgage as the manufactured homes appreciate slower than the other types and tend to have a useful life of 30-55 years. Even so, since 1976, the Department of Housing and Urban Development (HUD) enacted the HUD Code to improve the quality of pre-fab homes, however, at a higher price.

In addition, many people perceive manufactured homes negatively, and even some municipalities have raised zoning barriers to avoid installing this type of home. I think these disadvantages have caused people to stay away from manufactured homes. Yet, the government is taking action to increase house affordability, and one of the proposals is to increase access to debt at lower interest rates when buying manufactured homes (this type of loan is seen as a chattel loan and not as a mortgage) and to review some requirements of the HUD Code. Given the affordability crisis, I believe the government will significantly promote more affordable homes through manufactured homes.

Modular homes are similar to in-site-built homes and are not negatively perceived by the public. They also tend to be cheaper than in-site-built homes, but it will depend significantly on the transportation cost. The pre-fab homes industry is not an industry in which a player can produce all the modules and homes in a location with cheap manufacturing costs (energy, labor, and access to raw materials); instead, plants and retail locations must be close to customers’ lots to compete effectively with in-site homebuilders. In this sense, Cavco Industries (CVCO) considers that to be cost-effective, a plant must be within 350 miles of the customers, as transportation costs soar when the distance is larger. That’s why Skyline has so many manufacturing plants and retail locations across the U.S. and Canada.

Skyline Champion Skyline Champion

Nonetheless, it doesn’t mean companies can’t develop economies of scale. The largest companies can obtain better discounts for raw materials than smaller firms, as they can concentrate the purchase of several manufacturing facilities in one order.

Inside the pre-fab homes industry, 35 producers own 146 manufacturing facilities. The market is highly concentrated as the top 3 producers account for 80% of HUD Code homes sold. Skyline is the second-largest producer after Clayton Homes (a private company owned by Berkshire Hathaway). Skyline had a market share of 20.4% in 2023 and 17.9% in 1Q24. The firm has demonstrated to compete effectively through its growth strategy based on organic (customer satisfaction and production improvements) and acquisition-based growth, as its market share in 2017 was 13.9%. Meanwhile, the market share of the top 3 producers passed from 77% in 2017 to 80% in 2022. Thus, Skyline has grown even faster than the top 3 largest producers as a whole. Moreover, the stability of the top three’s market share indicates that the market is not susceptible to disruptions in innovation and has at least mid-barriers to entry due to economies of scale (purchasing power), in my opinion.

I think Skyline’s strategy is perfectly tailored to industry trends and characteristics. First, Skyline partnered with ECN Capital Corporation (creating Champion Financing) to better serve the financial needs of the manufactured home market by offering floorplan financing for retailers and loans for customers. With the formation of Champion Financing, Skyline no longer has a disadvantageous position from depending on third parties for floorplan financing and chattel loans and now equalizes Cavco Industries, which has been offering financing before Skyline. Second, through acquisitions and increasing production, Skyline is consolidating as one of the largest manufacturers of homes in the US, allowing it to achieve economies of scale through a concentrated purchasing power. Moreover, with the acquisition of Regional Homes (the fourth largest company), Skyline will keep growing, consolidating its market share, and expanding its retail network. Third, Skyline is trying to automate its production to not depend heavily on its labor force and to achieve a higher production efficiency by generating lower waste and better quality. This is an important aspect, as the production process (assembly-line process) remains labor intensive; for instance, Cavco Industries employs between 100-300 people in each manufacturing facility. In addition, I believe Skyline and the other top largest producers. Fourth, Skyline is adding customization to its homes, lowering the gap between the high level of customization provided by in-site-built homes and modular and manufactured homes.

Financial Performance and Industry Outlook

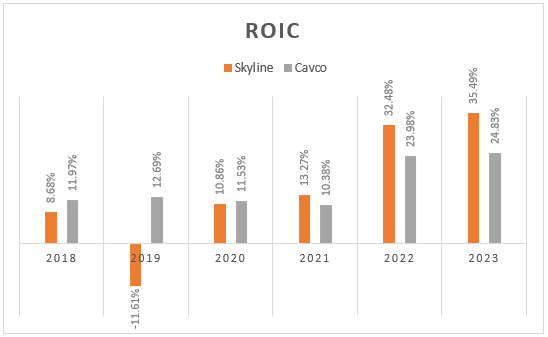

After the pandemic, Skyline demonstrated a higher ROIC than its peer, Cavco. Nevertheless, the demand during these years increased compared to pre-pandemic years, as the home shortage became more acute and households had more savings to spend, which drove to an undersupply and higher prices. Furthermore, during 2023, even if the prices of raw materials were falling, the demand in the industry remained high due to a large backlog and the Federal Emergency Management Agency (FEMA) orders, which made the profitability soar. However, the positive environment of free money and pent-up demand is over, and Skyline didn’t have better returns on capital than its competitor before the pandemic.

Author’s Elaboration with data from QuickFS

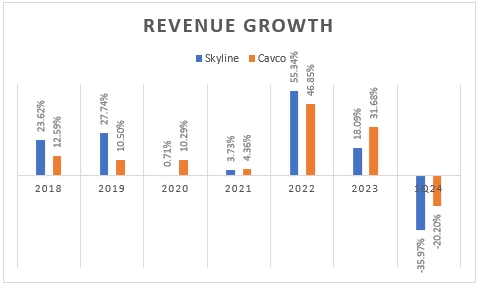

Nevertheless, Skyline has grown faster, indicating the success of its growth strategy. Even so, the company sales in 1Q24 plummeted by -35.97%, while Cavco sales only fell by -20.2%. Moreover, even if it’s not entirely comparable, the sales of HUD-code homes for three months ended on May 31 tanked by 29%, which gives us an idea of how the industry is being affected by higher interest rates and, hence, a decreasing demand. Skyline revenue fell further owing to the FEMA’s orders effect in 2022 (these orders typically have a higher average selling price and margin).

Author’s Elaboration with data from QuickFS

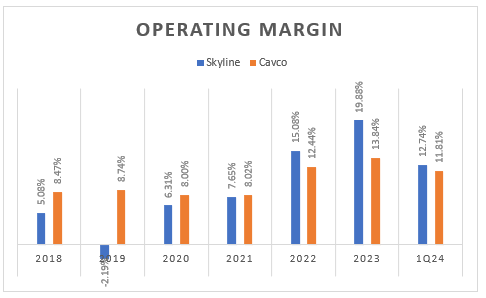

Finally, Skyline has recorded higher operating margins than Cavco, even in 1Q24, when its revenue fell significantly more than Cavco’s. The operating margin experienced a contraction as the company relied on operating leverage to achieve an operating margin of 19.88%. Additionally, unlike Cavco, Skyline experienced losses in 2019 due to a high equity compensation cost.

Author’s Elaboration with data from QuickFS

From my perspective, it’s difficult to say that one company is better managed than the other, both have weaknesses and strengths. Both have a positive net cash reserve and experienced strong revenue growth after the pandemic; however, Skyline grew faster and took more market share in the previous years. Even so, Cavco outperformed Skyline in profitability in pre-pandemic years, which I believe has considerable weight as the future conditions won’t be as favorable as before.

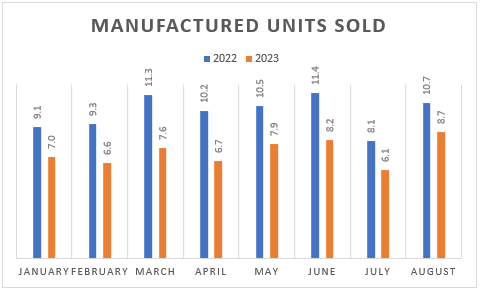

Now, analyzing the industry’s current state, the demand has fallen as interest rates increase the costs of retailers (floor planning) and final consumers. Moreover, there is no established secondary market for manufactured home loans, as they are treated as chattel loans, not mortgage loans. Thus, interest rates are higher for this type of house, which partially offsets its principal competitive advantage over in-site-built homes: its lower price. The lower demand has manifested in Skyline’s average selling price as it decreased by 8.2% in 1Q24, and the backlog fell to $260 million compared to $1.4 billion a year ago.

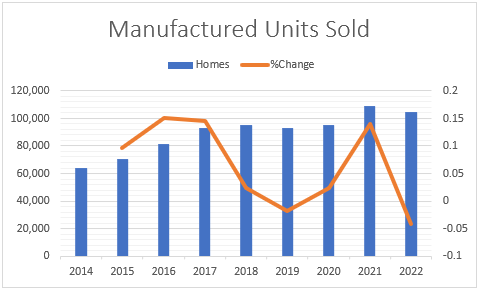

US Census Bureau

Nevertheless, even if units sold are down, the long-term tendency is positive, as more and more manufactured homes have been sold yearly; only in 2019 and 2022, the units sold decreased. Furthermore, units sold are far from the long-term historical average of approximately 200,000 units per year; however, in my opinion, no sign indicates a regression to the mean will occur.

US Census Bureau

Lastly, Mordor Intelligence expects the US prefabricated building market to grow at a CAGR of 5.94% until 2028, thanks to higher efficiency and lower costs of prefabricated homes compared to in-site-built homes, which is gaining importance as the country experiences an affordability crisis.

Other Risks

Negative Perception

Suppose people and municipalities continue to have negative perceptions of manufactured homes. In that case, it’ll be difficult for the whole industry to keep increasing the units sold yearly, which could lead to stagnation at some point.

Operating Leverage

Relating to economic conditions, the company relies on spreading its fixed costs over the maximum quantity of homes possible. Hence, continuously decreasing the number of homes fabricated could significantly worsen Skyline’s profitability.

Property Taxes

Increases in property tax rates or fees on developers by local governments, home insurance premiums, or changes to individual tax rules concerning the deductibility of mortgage interest expenses and real estate taxes can adversely affect the ability of potential customers to obtain financing or their desire to purchase new homes, which could hurt the company’s business and results of operations.

Failure to Improve Financing Options

Skyline depends on the government’s success in fostering manufacturing home financing options by creating secondary markets and changing the denomination from chattel to mortgage. However, some challenges exist as manufactured homes tend to have shorter useful lives and appreciate slower than modular and in-site-built homes.

Valuation

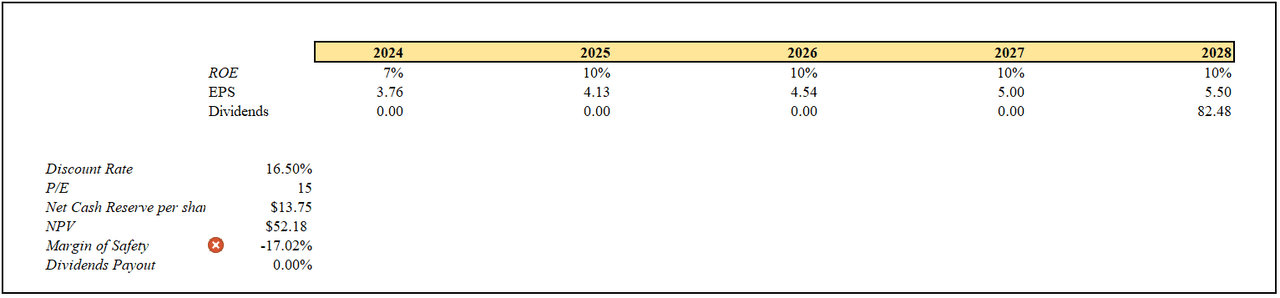

The average ROE since 2018 is 15.63%, however, the returns have been volatile. Thus, the mean is not so helpful. Consequently, I will use an ROE of 7% in 2024 and, for the rest of the years, an ROE of 10%. Moreover, I expect the company not to pay dividends, so the EPS will grow at the same rate as the ROE. As the company is within a highly cyclical industry, I’ll use a discount rate of 16.5%. Finally, my terminal value will be a P/E of 15, and the EPS in FY2023 will be 3.51.

Author’s Elaboration

Given my Dividend Discount Model, Skyline’s stock seems slightly overvalued at its current price. Nevertheless, the returns in the past have been volatile, and the uncertainty ahead is high; that’s why I prefer to use a low ROE compared to its historical mean. Moreover, the model contemplates multiple compression as the P/E forward is approximately 18. Consequently, my recommendation is a ‘Hold.’

Conclusion

I recommend a ‘Hold’ position for investors. While the company has experienced strong revenue growth and has a positive net cash reserve, several factors suggest caution. Firstly, the company operates in a highly cyclical industry, which makes it vulnerable to economic downturns. Secondly, the returns in the past have been volatile, and the uncertainty ahead is high. Finally, my Dividend Discount Model suggests that Skyline’s stock is overvalued at its current price. While a ‘Hold’ recommendation may seem neutral, it is essential to note that it is not a positive endorsement of the company’s prospects. Instead, it is a cautious approach considering the risks and uncertainties associated with investing in Skyline Champion.

Read the full article here