In every comment section here on Seeking Alpha of all Verizon Communications Inc. (NYSE:VZ) articles, you will see ardent bears declaring that the end is nigh for this stock. In fact, you will see frequently laundry lists of reasons of why Armageddon is coming for this stock.

Well, that fear has been allayed this morning with just reported earnings. While the bears have been correct, as the stock has been crushed from $38 down to $30 in the time we really started following it more heavily, and buying it from $34 at our investing group, the fact is that the operational situation is improving. Sure, feel free to go to the comments and lambast us about the debt and how much of a disaster the stock is. We are taking a long view and collecting the dividend, which is well-covered by the way. Competition is brutal in this space, but no one is giving up their phone and connectivity.

There is pricing power here, and it is only a matter of time before the entire industry sends the Angels of Mercy, in sticking with our Biblical analogies, and raises prices across the board. This goes for AT&T (T), T-Mobile US (TMUS) and the dozens of other “also rans.” For now, bears, you have indeed had the upper hand for Verizon and AT&T as these companies have been in intense competition through promotions to attract and retain companies. They pay for your new phones, benefitting the likes of Apple (AAPL) and Alphabet/Google (GOOG), and cut their pricing to the bare bones to get you in the door. It would be interesting to see how many of the very vocal bears on these threads actually have an account with AT&T or Verizon. We’d wager it is more than 20%. We digress. With that said, the idea of Armageddon coming for Verizon hath fallen with these results.

While it is true that the just-reported Q3 earnings were mixed, at these levels the stock looks to have put in or is near its bottom. That is a bold call, but we are making it. The bottom line is that from these levels, this is a great stock for long-term income and/or compounding in a tax-favored account as well. For trading, it also makes a good buy as we anticipate the stock to claw back over $35 this quarter. We also love a buy-write options strategy here for added income, something we guide our investing group members on how to execute for their own cash flow.

Simply put, we have suggested, and reiterate, that Verizon shares are a buy.

Verizon Q3 results in context

While the Q3 earnings season is just getting underway, there still remain concerns over guidance and concerns over the health of the consumer. Verizon revenues were pretty much in line with consensus expectations on the top line and saw a beat on the bottom line, but the outlook was in line with its last update, which we think is bullish.

We recently laid out our expectations for earnings from Verizon. You can take a look at those forecasts here:

Verizon: A Pivotal Moment.

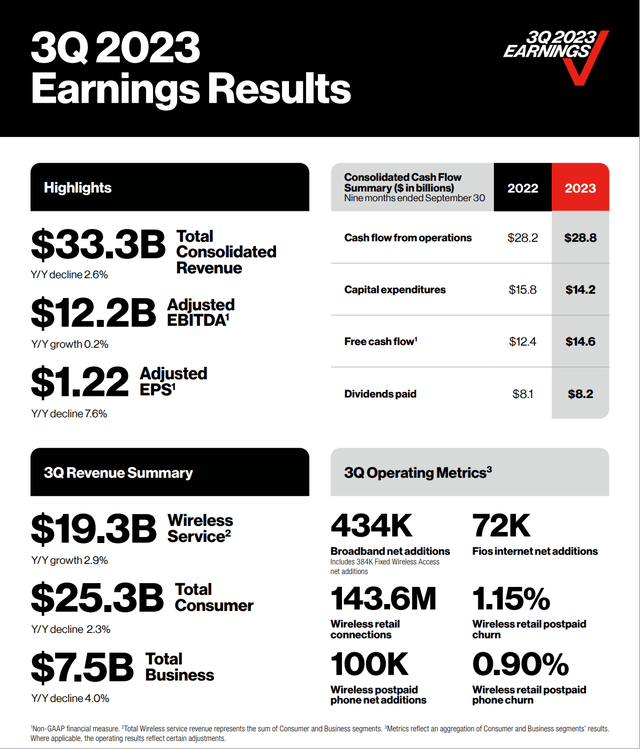

For the most part, our forecasts were pretty close, and while we thought Verizon may have difficulty with margins and earnings from being very promotional to attract customers, they saw nice results relative to our expectations. Revenue came in at $33.3 billion and was down 2.6% from last year. See the infographic below:

Verizon

The comparisons of interest you should be aware of are largely summarized above for Q3. What about the revenue drivers?

Verizon’s Q3 2023 revenue drivers

As we saw, revenues were down 2.6% but in-line, essentially. For Q3, we were looking for $33.25-$33.65 billion for the top line, so these results were within our projections. We do still think that Q4 will see a seasonally strong period, we have to tell you. But what about customer additions? We were looking for retail postpaid net additions of 175,000+ and wireless postpaid phone gross additions to increase single-digits year-over-year. We were also looking for churn below 1.0% for retail postpaid customers. For broadband, we were looking for net additions of 400,000 and were projecting 40,000+ Fios Internet net additions.

Our projections were relatively reliable. In wireless, there were postpaid phone net additions of 100,000 and retail postpaid net losses of 207,000 but business adds of 330,000. Churn came in a bit higher than we were looking for at 1.15% overall, but consumer wireless retail postpaid churn was almost in line with our expectations at 1.04%, and wireless retail postpaid phone churn was 0.85 percent. Business wireless retail postpaid churn was 1.47%, and wireless retail postpaid phone churn was 1.14 percent.

Over in broadband, there were net additions of 434,000, reflecting a strong demand for fixed wireless and Fios products. There were 384,000 fixed wireless net additions, an increase of 42,000 fixed wireless net additions last year. That marked the fourth consecutive quarter that Verizon reported more than 400,000 broadband net additions. There were 72,000 Fios Internet net additions. All in all, the company performed well relative to what we laid out that you could expect.

Verizon Q3 earnings outperformance

For Q3, we were looking for similar cost controls that we had seen in Q2. Q3 2022 operating expenses were $26.3 billion, and for Q3 2023 we were targeting operating expenses of $25.5-$25.8 billion, and operating income of $7.9-$8.0 billion. We saw operating expenses come in at $25.8 billion and operating income of $7.5 billion. Pretty close to our estimates, though operating expenses were higher than we would have liked.

For adjusted EBITDA, we were targeting $12.1-$12.4 billion and on a per share basis, we saw EPS of $1.18-$1.25 for Q3. Analysts were looking for $1.18, the low end of our target, and the company hit $1.22 in EPS, so that was a strong beat. Adjusted EBITDA was actually up 0.2% from last year to $12.2 billion. We think these results suggest that the end is not nigh for the company.

Free cash flow

As you all know if you have been following our work, or if you are a member of our investing group especially, you know that we harp on cash flow. It is all about the cash flow for these high dividend-yielding stocks. Cash flow tells us whether the dividend is covered, and if it is safe. We projected that for Q3, there would be positive dividend coverage. We were assuming cash from operating activities of $10.5-$11.0 billion, capex and other expenditures of $4.5-5.0 billion, and projected free cash flow of $5.5-$6.5 billion. For all of this, we saw a 40-50% payout ratio of the $2.8 billion in dividends.

Well, we were pretty close. Cash flow from operations was strong at $10.7 billion. Capex was $5.4. Keep in mind that Verizon pays more each year to the dividend. Dividends paid were about $2.75 billion in Q3. Free cash flow was $6.6 billion. As such, the free cash flow payout ratio was 41.6% here. For the year, we are still anticipating a payout ratio of less than 75%. Folks, free cash flow this year is $14.6 billion so far, up $2.2 billion from $12.4 billion in the commensurate 2022 period. And, our projections were largely exceeded on this front.

The debt, a harbinger of Armageddon?

So, if there is one thing that we hear left and right, it is about the debt. The debt will be the end of Verizon and AT&T, or similar statements, are made often in our public articles. We will let you in on our thought process that we reserve for our investing group. These companies need the debt to keep the gravy train running. They need the debt for new investment in spectrum auctions, debt to fund all of those free iPhones many of you love, debt to fuel investment into new infrastructure and more. Our prediction? The debt will never, ever be paid off. But leverage will be reduced, so that it is not eating up so much of the cash coming in to pay interest and principal. Yes, the debt burden is large. Interest expense will continue to climb on new debt at higher rates in this climate. So, the company is trying to chip away at the debt.

Coming into Q3, the net debt was still massive at $131.4 billion with a debt to adjusted EBITDA ratio of 2.6X. We were projecting debt to fall to $130.7-$131.0 billion. Well, this was one spot that we got it wrong. The company ended the quarter with net debt of $122.2 billion, and was down $4.3 billion in the quarter. This results in a debt to adjusted EBITDA ratio of 2.6X.

Final thoughts

Our projections were pretty spot on, with Verizon Communications exceeding our expectations in some areas, and coming up short in others. The company reiterated guidance for 2023 earnings. Guidance was reiterated at $4.55 to $4.85 per share. Of course, shares are down from a year ago because Verizon did see $5.18 in EPS in 2022. So, at $31 a share here, that means Verizon Communications Inc. stock is 6.6X FWD EPS at the midpoint. We will point out that the company is looking for $18 billion in free cash flow, which is a $1 billion guidance increase from the last guidance.

Verizon stock is still cheap in our estimation. The yield is attractive. But one thing is for sure, these results show that the idea of Armageddon for this company and the stock has been dispelled.

Have some thoughts?

Do you have thoughts here? Are you one of the perennial bears that see the company going bust? Do you think the company can reduce leverage? Do you agree with us that the company will never be debt free? Are you long and collecting the dividend? Are you trading options on the stock, or embracing an approach to trade around the core position to magnify gains? Have something else to add? Let the community know below.

Read the full article here